With modern technology, it’s now easier than ever to keep track of your finances from anywhere, at any time. You no longer need to carry around a bulky ledger or balance your checkbook. It’s simple to sign into your AMNB mobile banking app and check your balance, review your transactions, and even pay your bills. With all of this information at your fingertips, it can serve as a powerful resource to help you better your financial habits, keep track of savings, and plan for the future.

There is a huge market for personal finance apps to help make this happen. Often times, they can hook right into your mobile banking app to provide a clear, up to date picture of your financial standing. Here are a few of the best!

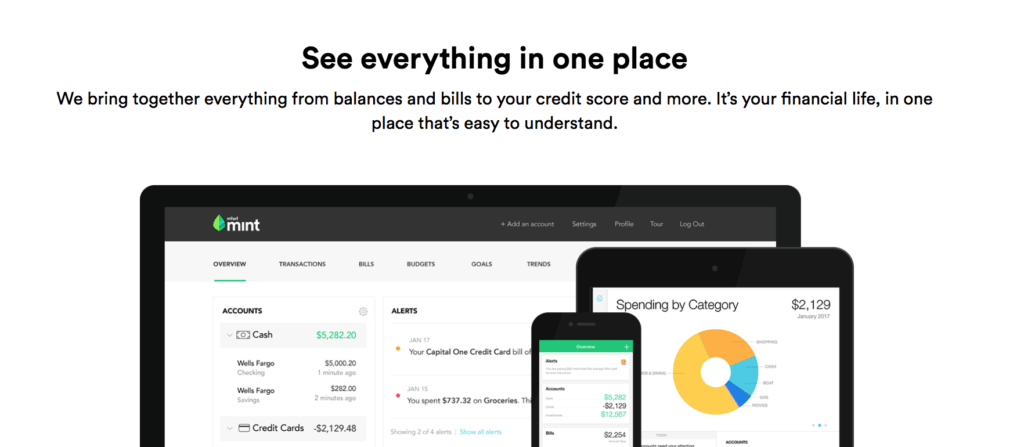

Best App To Stay on Top of Your Budget

Mint is one of the leading budgeting apps on the market, available on iOS and Android as well as from your desktop browser. This application links directly into all of your accounts including your personal checking, personal savings, credit card accounts, and even loan accounts. Compiling all of this information in one place provide you with a 360 view of your financial standing.

With this powerful app, you can throw out your budget binder! Mint lets you build your budget right into the app. It will let you know if you go over on the money you’ve set aside for your groceries or if your auto insurance rate suddenly goes up. Your budget can also be tied to savings goals, so they let you know if you skip out on a transfer.

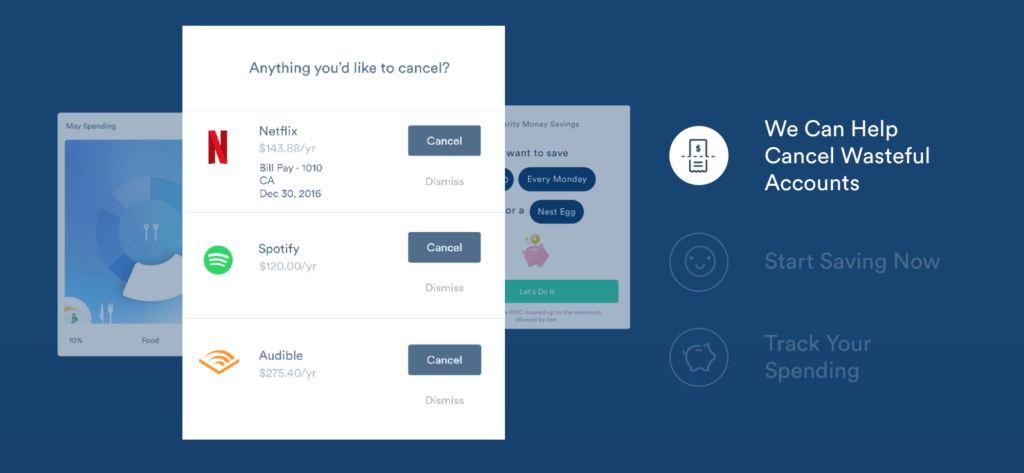

Best App To Eliminate Wasteful Spending

Clarity Money is another budgeting app that can provide a 360 view of your finances, but there are a few unique features that help you identify areas where you could be spending your money more wisely. Every few days, Clarity will send you a notification regarding the amount of money you’ve spent over the past few days. It’s a friendly little reminder that maybe splurging on that pair of shoes you’ve been eyeing wasn’t quite necessary.

They also categorize your spending for you so that you can see how your spending fluctuates over time. Maybe you spend more time eating out in the summer or spend more on groceries around the holidays? These are all just reminders to be more conscious about when and where you swipe your card.

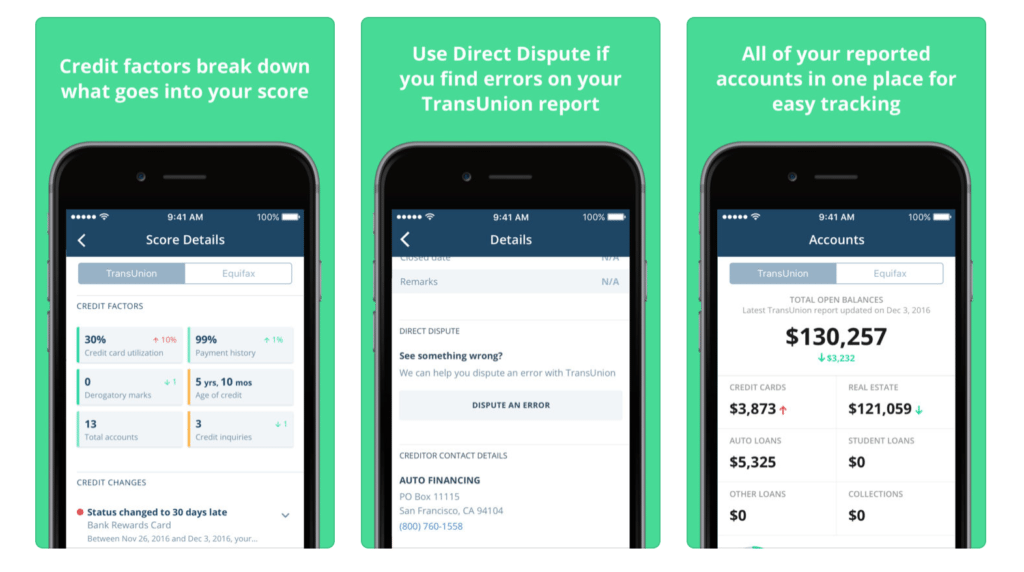

Best App To Stay On Top of Your Credit

Credit Karma has been taking the credit industry by storm with a totally free website that you can use to check your credit score without getting points knocked off. Now, they’ve evolved into a handy mobile application! At a glance, you can see your credit score from both TransUnion and Equifax. With a deeper dive, you can see how your score has fluctuated over time and what factors are raising or lowering your score. They also show you how your debt levels have fluctuated as you pay down your loans or increase your credit card balance.

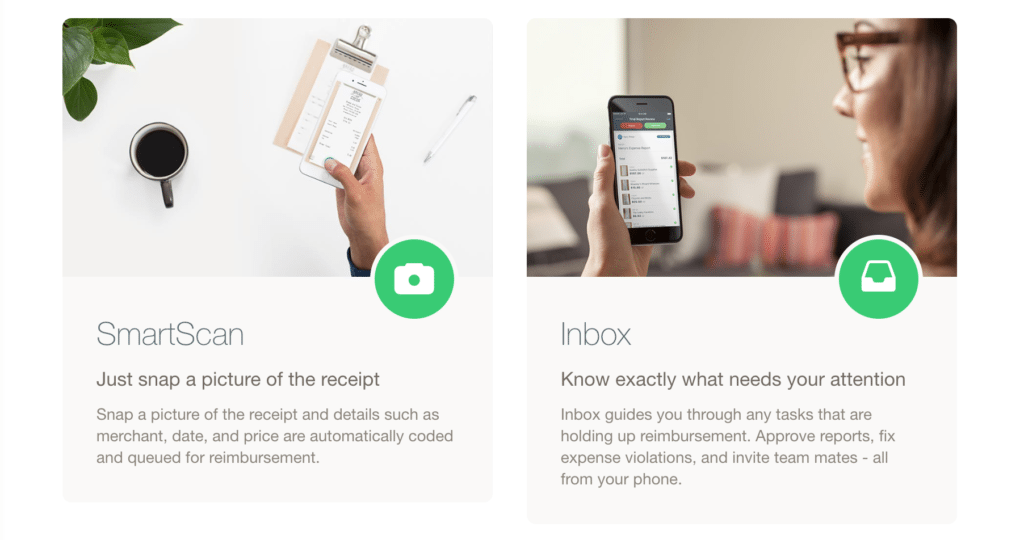

Best App to Track Business Expenses

When you’re a frequent traveler for your business, it’s easy for your finances to get lost in the gray area, especially if you’re running your own business. Expensify is a free application on iOS and Android that helps you keep track of your business expenses. You can manually track your expenses and upload photos of your receipts so that you can have an automated expense report when you return from your trip. It can even help you calculate your mileage reimbursement!

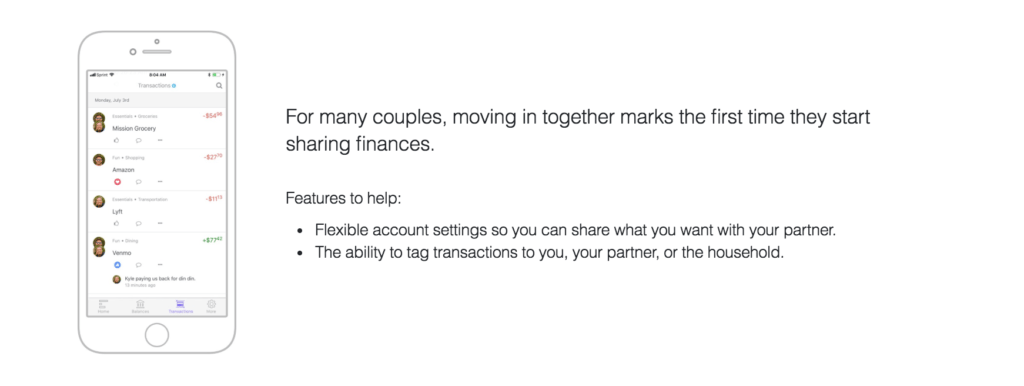

Best App to Help You Combine Finances

One of the biggest challenges of being in a domestic partnership is figuring out how to combine your finances fairly. Honeyfi is here to help.

This free application for iOS and Android is made for collaborative budgeting in your household. You can connect both individual and joint accounts to get a clear picture of financial crossovers and silos. You can set up categories and even leave comments attached to transactions. This way, there is a clear line of communication about your money and everyone is on the same page.