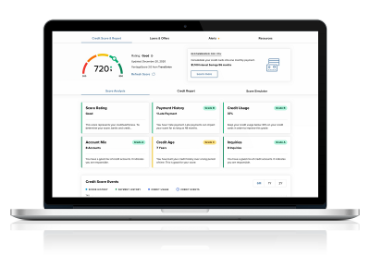

Instant & Free Access to your Credit Score!

Credit Score from SavvyMoney is a free service provided by American National to help you understand your credit score and access your full report daily. Benefits of knowing your score include the ability to:

- Receive daily credit monitoring with alerts for major changes

- Identify credit bureau errors

- Understand the factors that impact your score, and

- Work toward your financial goals!

Get Started

To access your credit score, just log in to your online or mobile banking and click the "Credit Report" link in the navigation menu.